child tax credit september 2021 date

Have been a US. More than 30million households are set to receive the payments worth up to 300 per child starting September 15.

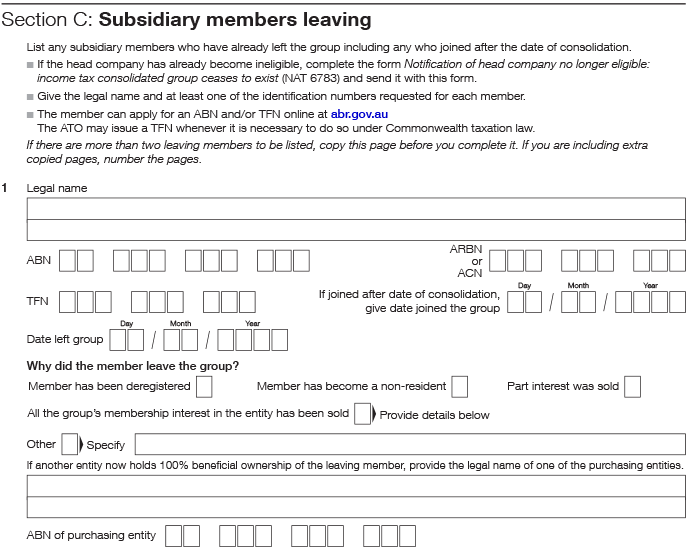

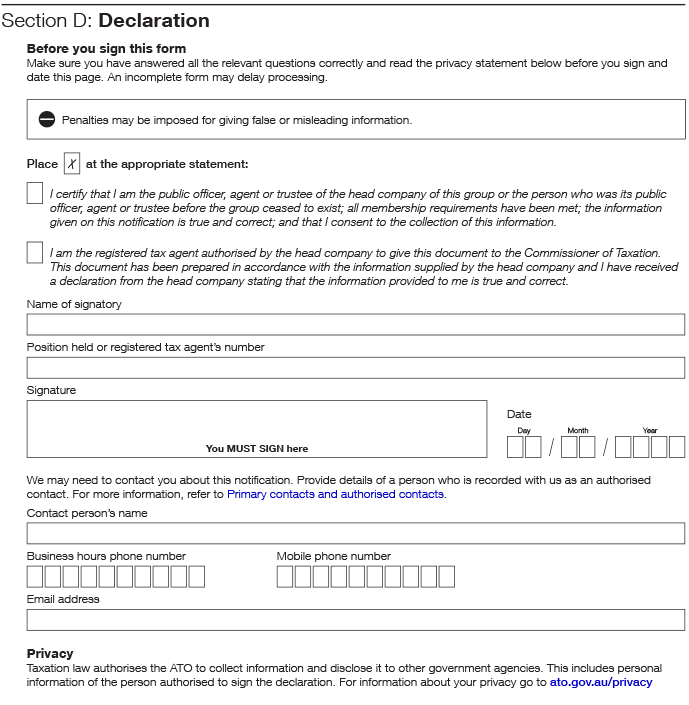

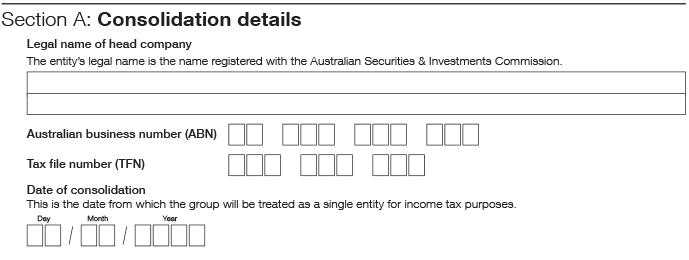

Notification Forms And Instructions Australian Taxation Office

15 opt out by Aug.

. We dont make judgments or prescribe specific policies. 15 opt out by Nov. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

Those with kids between ages six and 17 will get 250 for every child. Families with kids under the age of six will receive 300 per child. September 14 2021 1235 PM CBS Chicago CBS Detroit -- The third round of Child Tax Credit payments from the Internal Revenue.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. File a federal return to claim your child tax credit. Wait 10 working days from the payment date to contact us.

September 16 2021 735 AM MoneyWatch. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of cash to millions of families. 29 What happens with the child tax credit payments after December.

Families will receive up to 300 per child when the next round of child tax credit payments lands in bank accounts Credit. On the 15th day of each month families across the United States are supposed to receive advance payments of their 2021 child tax credit. Families who chose to receive advance credits in 2021 will receive their third monthly installment on September 15.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment. Simple or complex always free.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. See what makes us different. 13 opt out by Aug.

The updated Child Tax Credit is based on parents modified adjusted gross income AGI as reflected on their 2020 tax filing. 31 2021 so a 5-year. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. IRSnews IRSnews September 14 2021.

Those who opted out can expect to receive a lump sum next year. Child Tax Credit. The IRS is sending families the September installment of the 2021 Child Tax Credit on the 15th but how long will it be before it arrives in bank accounts.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year. 15 opt out by Oct. All payment dates.

October 5 2022 Havent received your payment. The IRS bases your childs eligibility on their age on Dec. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. Payments will start going out on September 15. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. IR-2021-188 September 15 2021. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. When Will Your September Payment Arrive. 15 opt out by Nov.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

When Are Taxes Due In 2022 Forbes Advisor

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Save The Tax Dates The Turbotax Blog

Budget Overview 2022 23 Budget

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Notification Forms And Instructions Australian Taxation Office

Child Tax Credit Will There Be Another Check In April 2022 Marca

151 Trains Proposed To Be Run By Private Operators Proposal Train Operator

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

The Ultimate Guide On How To Do A Bas Statement Box Advisory Services

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Notification Forms And Instructions Australian Taxation Office

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest